VAT refund Thailand for tourists

P.P.10 and eligible purchases

🛍️ VAT Refund Thailand

Foreign tourists can reclaim VAT on purchases when leaving Thailand. Make sure you shop at participating stores and get the VAT Refund for Tourist Form (P.P.10).

What is P.P.10?

The P.P.10 form is the official document issued by the shop proving that VAT was paid during your purchase.

This form must include:

- Shop registration number

- VAT refund logo (blue-yellow sign)

- Total purchase amount

- Your passport details

- Invoice number

- Signature from the store staff

You will need this form stamped at the airport before check-in, especially for high-value goods such as electronics, jewelry, or watches. Without a properly completed P.P.10 form, the Revenue Department cannot process your VAT refund.

🛫 What Is the Purpose of the VAT Refund Thailand Program?

The VAT Refund Thailand program was created to encourage international visitors to shop in the country while supporting local businesses. Instead of paying the full 7% VAT on high-value items, tourists can request a partial refund of this tax when leaving Thailand. The system works only with approved shops and requires correct documentation, mainly the P.P.10 form, which you must obtain at the time of purchase. Understanding these steps helps travelers avoid mistakes and ensures they receive their refund at the airport.

🛍️ What Types of Goods Are Eligible?

Not all purchases qualify for a VAT Refund Thailand. The system focuses on products that can realistically be exported, such as:

- Electronics

- Fashion and clothing

- Leather goods

- Jewelry

- Watches

- Cosmetics (unused, sealed)

- Health & beauty products (sealed)

- Souvenirs

- Sports equipment

Small items like drinks, snacks, and anything you consume before departure cannot be refunded because they are considered non-exported goods. Even if bought at a participating shop like 7-Eleven, eligible items must be unused, sealed, and taken out of Thailand.

👤 Who Can Claim

- Non-Thai nationals who do not reside in Thailand.

- Departing from an international airport.

- Purchases from stores showing the “VAT Refund for Tourists” sign.

📦 Purchase Requirements

- Minimum purchase: 2,000 THB per store per day.

- Goods must be taken out of Thailand within 60 days.

- Keep goods unused and ready for inspection.

Items that have been opened, used, or consumed (like drinks or cosmetics) are not eligible.

💰 How to Get Your Refund

- Refunds under 30,000 THB: cash or credit card.

- Refunds above 30,000 THB: bank draft or credit card transfer.

- Bank drafts or transfers may have small fees.

❌ Common Reasons Refunds Are Denied

- Goods not inspected by customs.

- P.P.10 form missing or invoices incomplete.

- Purchased from non-participating stores.

🛫 Step-by-Step Claim Process

- Shop at participating stores and request P.P.10.

(This is the official VAT refund form you will need at the airport.) - Keep goods unused and ready for inspection.

- Present goods + P.P.10 + invoices at the airport before check-in.

- Get refund at VAT counter after immigration.

For refund amount not exceeding 30,000 baht, the refund payment can be made in the form a

1.1 Cash (Thai baht only) or

1.2 Bank draft in four currencies: US$, EURO, STERLING, YEN or

1.3 Transfer into Credit card account (VISA, MASTERCARD, and JCB)

2. For refund amount exceeding 30,000 baht, the refund payment can be made in the form of bank draft or transfer into a credit card account (as detailed in 1.2 and 1.3)

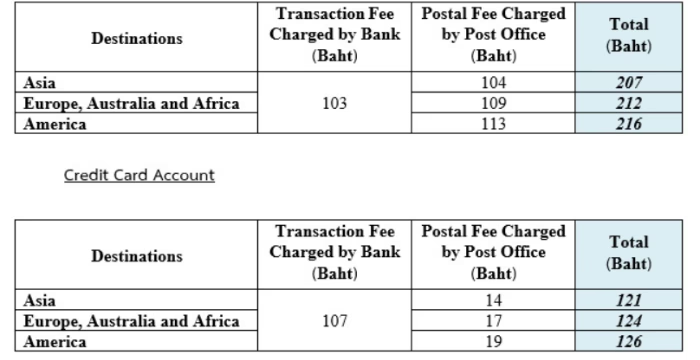

The expense consist of draft or transfer fee, and postal fee which are charged by banks and post office and they will be deducted from the refund amount. Below tables are shown the approximately rate of the expenses.

For more practical information about money in Thailand, check our Thailand Currency Guide — THB ⇄ EUR / USD Converter.

🌴 Tips for Travelers (Phuket Edition)

- Keep all documents organized and accessible.

- Check value thresholds for luxury items.

- Allow extra time at Phuket International Airport for processing.

📘 Official Sources – VAT Refund Thailand

These links provide the full rules, eligibility, required forms (P.P.10), and refund office locations.

🤝 Our Trusted Travel Partners

To make your trip planning easier, we recommend using these trusted services:

Book your stay with Agoda – trusted by millions for the best hotels in Thailand and beyond.

Most popular destinations:

Bangkok Hotels |

Phuket Hotels |

Pattaya Hotels |

Chiang Mai Hotels |

Chon Buri

Find cheap flights to Thailand – compare prices across multiple airlines and booking sites.

Most Popular flight routes:

USA (JFK) to Bangkok Flights |

UK (LHR) to Bangkok Flights |

Germany (FRA) to Bangkok Flights |

Australia (SYD) to Bangkok Flights |

Japan (NRT) to Bangkok Flights |

Zurich (ZRH) to Bangkok Flights |

Milano (ZRH) to Bangkok Flights

If your airport isn’t listed, search flights from anywhere

Explore tours and activities – book unique local experiences.

Popular tour destinations:

Bangkok Tours |

Phuket Tours |

Chiang Mai Tours |

Krabi Tours |

Pattaya Tours

If your destination isn’t listed, explore all tours and activities

Get travel insurance – protect your trip with reliable coverage.

Trusted providers:

EKTA Traveling Insurance |

Compensair Travel Insurance |